-

首页

-

出版物展开 / 收起

sidenav background出版物

sidenav header background张维迎教授《市场的逻辑》英文版书籍出版

发布日期:2019-01-04 11:48 来源:北京大学国家发展研究院

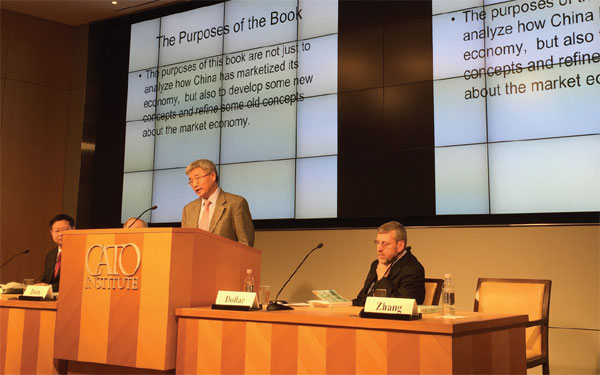

《China Daily》华盛顿报道:北京大学国家发展研究院经济学教授张维迎(中间者)正在对其新版的英文专著The Logic of the Market: An Insider's View of Chinese Economic Reform 进行演讲。

2006年诺贝尔经济学奖获得者、被誉为“现代宏观经济学的缔造者”的埃德蒙德•菲尔普斯和2011年诺贝尔经济学奖获得者托马斯•萨金特、哈佛大学中国问题专家PERKINGS为本书写了推荐语:

Weiying Zhang, a significant voice in China's policymaking and a star in its academia, presents in this book a deep analysis of China's extraordinary escape from poverty. I advise all students of economic development to read this important book

EDMUND PHELPS

Recipient of the Nobel Prize in Economics

Director of the Center on Capitalism and Society, Columbia University

This remarkable book testifies to the power of economic analysis to isolate basic economic forces that transcend countries and political regimes. People are people everywhere--for good or ill, they respond to incentives. This fascinating book has many insights about the ongoing struggle of some people in China to remove impediments to Adam Smith's invisible hand.THOMAS J.SARGENT

Recipient of the Nobel Prize in Economics

Professor of Economics, New York University; Senior Fellow, Hoover InstitutionIn this stimulating book, Weiying Zhang goes well beyond the usual review of China's recent reforms and future prospects. The strengths and weaknesses of reforms, what remains to be done, political and legal reforms, are all anchored in a discussion of the underlying principles and strengths of the market. He draws on the writings of the Austrian economists, Adam Smith, philosophers from early Chinese history, and contemporary experience to make his points. Established economists, students, and scholars will learn much about China and markets from this book.

DWIGHT H.PERKINGS

Professor of Political Economy

Kennedy School of Government, Harvard University

Preface to the English Edition

Weiying ZhangChina’s economic reforms that started in 1978 have had a tremendous impact on China, and even the world. On the one hand, after 30 years of high-speed economic growth, the living standards of the average person have greatly improved. There are more choices and more liberties. The international ranking of the Chinese economy has increased from 13th place before the reforms to 2nd place today. China has a greater voice in the international community. G2 has become part of the international vocabulary. There is even talk of the eastern transition of global leadership. On the other hand, with that high-speed economic growth, the various contradictions of Chinese society have become more prominent. Issues such as income inequality, regional differences, serious corruption in officialdom, health and education inequality, and environmental pollution have caused people’s feelings of dissatisfaction to increase instead of decrease along with the improvements in living standards.

Corresponding with these two phenomena are two groups with two ways of thinking about how to evaluate reforms of the past and guide reforms of the future that have arisen. I disagree with both. The first group, the China Model Theorists, believe that the source of the Chinese economic miracle was the unique “China Model.” Its basic characteristics are strong government intervention and a dominant state-owned economic sector. It is completely different from the road taken by Anglo-American and other Western countries. It is different from the free competition and private enterprise system advocated by the “Washington Consensus.” The second group, the Reform Failure Theorists, believe that China’s current social contradictions are caused by marketization. They believe that 30 years of marketization reform policies were a mistake.

The China Model Theory was originally proposed by overseas scholars who researched developing countries (including China). After the 2008 Global Financial Crisis, certain Chinese scholars, and especially government officials, put faith in the idea. The Reform Failure Theory is mainly advocated by certain leftist Chinese scholars but has a significant following among ordinary people, and has even been acknowledged by certain high-ranking government officials.

In my view, these two ways of thinking, although they may appear different at first glance, are in essence the same. Both have blind faith in government power and distrust the logic of the market, have blind faith in the foresight of government officials but distrust the judgments of entrepreneurs, have blind faith in authority but distrust liberty, and have blind faith in “national conditions” and “characteristics” but do not accept universal values. The difference between the two is that the Reform Failure Theorists negate the market reforms of the past as a starting point to advocate returning to the era of central planning, government allocation of resources and incomes, eradication of private entrepreneurs, and state-owned enterprise dominance of the economy. To this they add a little abstract “direct democratic participation” from the masses. The China Model Theorists negate the marketization and democratic reforms of the future. They advocate solidifying the current system and power structure, relying on industrial policy to guide development, and using state-owned enterprises to guide the economy. As to whether their advocacy is based on principles or private interests, I do not know, but it is probably both.

On the surface, both of these ways of thinking have a certain basis in reality, but their understanding of reality is incorrect. Yes, if we compare China to Anglo-American developed countries, the biggest difference is that the Chinese government does intervene in economic and social affairs more, the proportion of state-owned enterprises is higher, and China has not established true democracy and rule of law. However, if because of this we attribute the past 30 years of China’s economic growth to government intervention and state-owned enterprises, as the China Model Theory advocates do, we are wrong. China’s reforms started with an all-powerful government under the planned economy. The reason China could have sustained economic growth during the process of reform was because the government managed less and the proportion of state-owned enterprises decreased, not the other way around. It was precisely the relaxation of government control that brought about market prices, sole proprietorships, town and village enterprises, private enterprises, foreign enterprises, and other non-state-owned entities. Not only did the Chinese economy not collapse, in fact it maintained a relatively high rate of growth. It should also be pointed out that the past 30 years of China’s economic growth relied on technology and management practices that had accumulated in Western developed countries over the last few hundred years. These technologies and management practices could not possibly have been created by China’s high levels of government intervention and economy dominated by the state-owned sector.

High levels of government intervention and state-owned enterprise dominance are not the reasons for the Chinese economic miracle. In fact, those things are the reason for the contradictions and unfairness in Chinese society that the Reform Failure Theorists exaggerate. Government control over large amounts of resources and excessive intervention into the economy are the direct cause of cronyism between officials and businessmen, are a breeding ground for official corruption, seriously corrupt commercial culture, and damage the market’s rules of the game. The monopoly profits extracted by monopolistic state-owned enterprises allow state-sector employment compensation to far exceed fair market levels. It is an important contributor to income distribution inequality. If China opened up the medical market earlier, allowing nongovernment capital to freely enter instead of maintaining the monopoly status of state-owned hospitals, it would not be so difficult and expensive to see a doctor. If nongovernment schools could open freely, China’s education quality would not be as poor as it is. If China could establish the absolute authority of the constitution and the law, putting government power below the law, there would not be as many cases of barbaric relocation as there are. If farmers truly held the right of land ownership, there would not be as many instances of unfair expropriation of farm land. If starting a business was the equal right of every person, instead of being a privilege bestowed on a group of people by government examinations and approvals, cronyism would not be as common as it is. If citizens had the right to vote and freedom of the press, government corruption would not be as unrestrained as it is today.

Unfortunately, during the 10-year reign of President Hu and Premier Wen, the China Model Theory and Reform Failure Theory were not limited to essays and catchphrases—they were put into practice. This has seriously impacted the direction of government policy, causing reform to stagnate and even regress. Over the last 10 years, the pace of reform has been obstructed by anti-reform sentiments and policy. Some traditional methods of the planned economy have been resurrected under the name of macroeconomic adjustments and industrial policy. Prices that have been liberalized are now subject to price controls. “Private advance and state retreat” as the mainline of ownership structure adjustment has given way to “state advance and private retreat.” For many years, government revenues have far outpaced the growth of the national economy and residential incomes. Government investment has begun to squeeze out private capital. Entrepreneurial fervor to do business has been replaced by a zeal to emigrate. Countless other examples have created institutional deficits for future economic growth and caused Chinese society to be less harmonious.|

Therefore, if China is to maintain sustained economic growth, understand the various social contradictions that it faces, or establish a truly harmonious society, it must be persistent in its reforms toward marketization, reduction of government control over resources and intervention into the economy, and the establishment of a true rule-of-law-society and democratic politics.

All debates over issues of China’s reforms reflect people’s common misunderstanding of the market. This misunderstanding is related to traditional economics. Traditional economics sees the market as only a means of efficiently allocating resources, not as an institutional arrangement for human beings to pursue happiness via the division of labor and cooperation. To prove the efficiency of markets, traditional economists made many assumptions. These assumptions are all unrealistic and unfounded and have destroyed the reputation of the market. They have also provided reasons for the government to intervene in the economy. The failure of market theory is mistaken as the failure of the market per se. In reality, the efficient operation of the economy does not require the assumptions of traditional economics. As an institutional arrangement for the pursuit of happiness via the division of labor and cooperation, the orderly operation of the market only relies on liberty, private property, and the rule of law. Economists have a duty to work toward establishing a better market theory.

The Logic of the Market: An Insider's View of Chinese Economic Reform

Weiying Zhang (Author)

Matthew Dale (Translator)

Paperback: 284 pages

Publisher: Cato Institute; Tra edition (January 16, 2015)

Language: English

ISBN-10: 1939709601

ISBN-13: 978-1939709608About the Author

Zhang Weiying is a prominent Chinese economist and professor of economics and director of the Center for Market and Network Economy of the National School of Development (NSD) at Peking University.The Book Link:

http://www.amazon.com/Logic-Market-Insiders-Chinese-Economic/dp/1939709601/ref=sr_1_1_twi_1?ie=UTF8&qid=1424984325&sr=8-1&keywords=The+Logic+of+the+Market%3A+An+Insider%27s+View+of+Chinese+Economic+ReformBook Description

The Logic of the Market by Weiying Zhang—considered China’s “leading market liberal”—comprises his most influential essays on economics over the past three decades. First published in China in 2010, this revised edition contains three new essays, which offer those outside China a deeper understanding of the Chinese economy. “Market competition is a really just competition to create value for others… Only through this approach did the Western economy advance over the past 200 years. It is also the reason for China’s economic marvel over the past 30 years,” writes Weiying. Readers will appreciate Weiying’s ability to address both everyday economic issues and the questions that confront a nation’s leaders, not the least a nation seeking to escape mass poverty.

The economic reforms and subsequent growth in China may be the most astonishing and hopeful event of our age. Weiying was among the leaders who set China on its path of change. Here he elucidates the pitfalls and the progress of economic reform, celebrating leaders who mixed sustained idealism with judicious compromise. Readers seeking to learn from China’s successes will find much of interest here. Weiying emphasizes the importance of entrepreneurs in the new China. He concludes, “The key for China, as the country with the world’s largest population, to return to being the largest economy lies in allowing the entrepreneurial spirit to develop the potential of the domestic market.” For that to happen, Weiying recommends that China continue to reduce the state-owned economy, lessen government control over the economy, and—over the next 30 years—emphasize political reform to build a constitutional democracy.

His thinking is not limited to China. Some of these essays also focus on the global financial crisis—how Keynesian policies can only be effective for the short term and will bring long-term negative consequences. Weiying provides a unique perspective on his country’s market economy, implementation of economic policies, and the potential for Chinese economic development. “I hope that the logic of the market becomes every person’s ideal,” he writes. “That is my reason for writing this book.”

国家发展研究院官方微信

Copyright© 1994-2012 北京大学 国家发展研究院 版权所有, 京ICP备05065075号-1

保留所有权利,不经允许请勿挪用